Luxurious residential development set in a breathtaking Paphos location with unobstructed sea views. The project includes five detached villas with their own seawater swimming pool and extensive gardens, designed to create an idyllic private space of the highest standard. Situated in an area with every amenity nearby, the land value of the project is set to further increase in the future, making it a highly attractive investment.

The project has been carefully designed so as to provide its buyer with the ultimate product. The villas offer the best of both worlds because while they are located in a quiet peaceful area with a spectacular view of the sea, at the same time they are only a few minutes’ drives away from the buzzing touristic and commercial center of Paphos. The sea is at a mere 50-meter distance. Kings Avenue Mall and at least two large supermarkets that can cover any consumer need are located within a 10-minute driving distance. ASPIRE Private British School, offering the British National Curriculum to children from the age of three, is also in the same vicinity. Paphos International Airport, which connects the island with a multitude of European and international destinations, is approximately 20 minutes away. The undoubtedly premium location of the villas should, therefore, constitute a major incentive to incite interest in the buyer and it is important to note here that the upcoming creation of the Paphos Marina and a premium-class entertainment park will contribute to the further value increase of the property. It is consequently an excellent cost-value investment, through which the buyer will be given the opportunity to obtain Cypriot citizenship.

In this section of the feasibility study, we will study and address data that are directly and indirectly linked with the project, such as the company’s objectives, project size, current market conditions, client needs, business model and value-added features.

The Amazon Quintet project aims to offer its ultimate users a unique experience of luxurious residential living. It also constitutes an excellent investment opportunity for any buyer who will buy the five villas and then lease them in order to earn passive income, an investment that will make him simultaneously eligible for Cypriot citizenship.

The company’s objectives are the following:

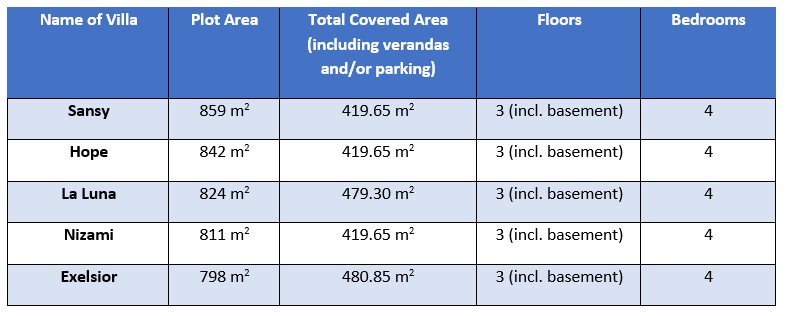

The project identifies itself as a luxurious residential development of high standards. The Amazon Quintet project consists of five luxury detached villas of 3 different types, in plot areas ranging between 798 sq. m to 859 sq. m each.

All the villas are set in a breathtaking location with unobstructed sea views, and they will be of a very high standard of specification and finishes, each having their own private swimming pool and a sizeable garden.

Further characteristics of the project and value-added points will be discussed in the following sections of this study in-depth, after first having an extended look at a macroeconomic analysis discussing factors that can affect property purchase in Cyprus. Finally, it is worth mentioning that Amazon Quintet is a privately funded development, with the owners funding and borrowing from save & loan associations, international funds, and private investors.

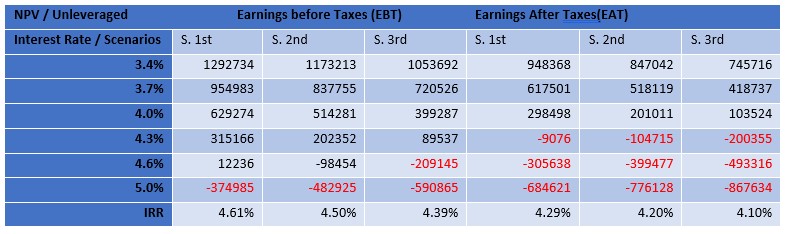

The purpose of this financial analysis is to assess the investment characteristics of the Amazon Quintet project as a real estate rental business through the estimation of the two main measurements of the capital budgeting process (the IRR and the NPV). Initially, we will calculate the Earnings Before Tax (EBT) and the Earnings after Tax (EAT) for the different scenarios and consequently the Net Cash Flows (NCF), on which the estimation of the capital budgeting metrics will consequently be based.

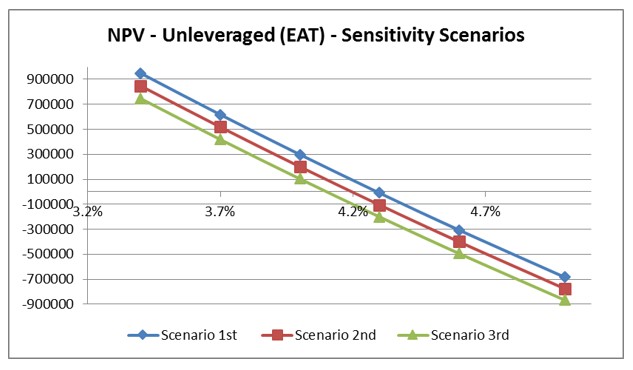

The Net Present Value Analysis will be carried out on both the Earnings Before Tax (EBT) and on the Earnings After Tax (EAT) which are presented in the tables below:

We have calculated the unleveraged NPV for the three total revenue scenarios and for a discounting rate in the range of 3.4% - 5%. The results are shown in the table below. The discount rate of the Amazon Quintet project is defined as the rate of return (RoR) that could be earned on a complex of luxury villas.

As we can see, the Amazon Quintet Project is more profitable compared to projects producing a rate of return (RoR) of up to 4% regardless of the sensitivity scenarios considered in our research.

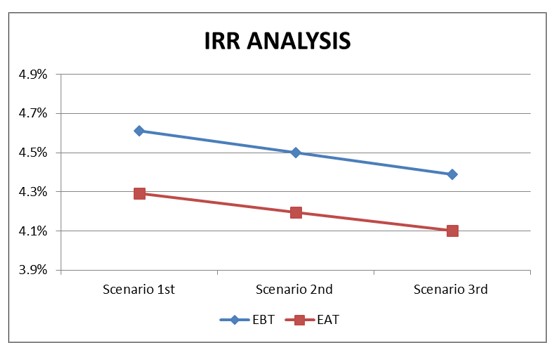

In our research, we have also used the second most prominent measurement of capital budgeting, the IRR. The table and the graph below show the IRR in the case of our scenarios.

As can be observed, the IRR ranges between 4.1% - 4.4%. This rate reveals an excellent investment opportunity since the majority of luxury properties for sale fail to outreach the margin of 4%.

Both the high NPV and IRR are results of the low sales price, and the stable and high cash flows from rents.

While the Amazon Quintet project constitutes a great investment opportunity, its IRR is higher than that of a similar complex of villas, which are part of a resort. Amazon Quintet residences’ IRR ranges between 4.1% - 4.4%, whereas that of the other villa complex ranges between 2% - 3%.

Amazon Quintet 1

Amazon Quintet 2

Amazon Quintet 2

Amazon Quintet 3

Amazon Quintet 4

Amazon Quintet 5

Amazon Quintet 6