Our subject is to identify potential strategic investors who would be interested in financing the constructions and organization of the modern highly profitable dairy farm. The main goal of the project is to create a high-tech, cost-effective dairy farm with a herd of cows, goats, and sheep, which will satisfy the needs of the existing milk processing company in raw milk and provide it with high-quality raw materials. All structures of the farm will be built and equipped taking into account modern conditions of keeping animals, building or veterinary standards.

I.The opportunity

The total project cost is estimated at approximately 6 million euros. A brief description of the expences is presented below:

Based on the feasibility study for the next 7 years prepared by the Research Department of Amazon Consulting LTD (Cyprus) on behalf of the Owner, the venture is expected to provide an IRR of 29%. In addition to becoming a cost-effective enterprise with a high rate of return (RoR), the farm will completely repay the investments including a profit (represented by the interest rate) of 5% per annum.

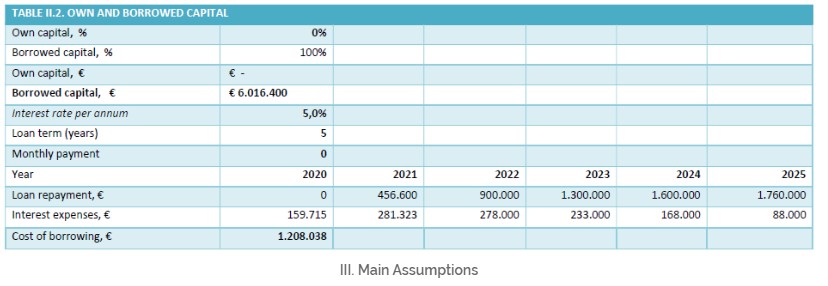

1. Investment method

In accordance with the project, the entire amount of necessary investments consists of "borrowed funds" and is provided to the investor from the project owner in the form of an investment loan (credit line) for a period of up to 6 years, providing for phased payments.

The feasibility study is based on the following assumptions:

IV.Snapshot of the Cyprus row milk market

IV.1. Raw milk quality in Cyprus and the aim of the Project

According to recent studies, the quality of milk provided for processing by Cypriot farms does not meet the standards established in the world for a number of parameters:

1) High somatic cell content in excess of the norms acceptable for drinking milk (it is 3 to 5 times higher than the maximum allowable concentration (MAC)).

2) A high content of antibiotics (in Cyprus farms animals get 40 times more antibiotics than in European countries).

3) Low-fat content of milk, which is due to unsystematic feeding of animals that do not take into account their type, age, weight, and level of milk yield.

The aim of the project is to create a modern high-yielding dairy farm engaged in the production of milk that meets international quality standards. All milk produced by the farm will be purchased and processed by an existing profitable dairy company. In addition, the creation of a dairy farm that takes into account all modern methods of keeping, feeding, treating and milking animals promises not only high profitability for the investor but also the introduction of positive practical experience in the activities of Cyprus farms.

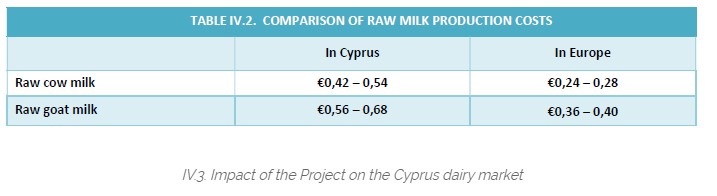

IV.2. Comparison of raw milk production costs in Cyprus and Europe

Inappropriate animal welfare conditions, irrational use of feeds and a lack of efficient herd management are the reasons for the high production costs of milk in Cyprus.

As we have already noted, the project’s aim is to create a highly efficient and profitable commercial dairy farm. The key element of the farm is the reduction of raw milk production cost to the European average by introducing modern technologies of animal welfare, using high-quality feeds and efficiently managing the herd. The project’s high profitability and competitiveness will be ensured both by the reduction of raw milk production cost in the environment of high purchase prices of this product and by its exclusive quality. The proposed project envisages the production of 5620 tons of milk per annum which amounts to 1.7 % of overall raw milk output in Cyprus.

V.Snapshot of Expected Profitability of the Project

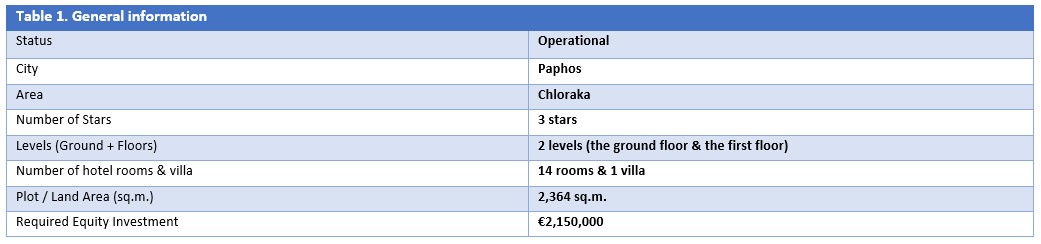

The Project’s launch is planned for January 1, 2020, and the farm will reach full capacity in 21 months since the moment of the project’s start.

It is planned to have 200 cows, 2900 goats, and 1400 sheep at the farm. The total number of animals is defined by the scale of the Owner’s demand for raw milk, and the herd structure is based on optimum technological proportions of milk mixture to produce halloumi. All milk produced at the farm would be sold to the existing company Miradar Ltd on a contract base and for market prices for its subsequent processing.

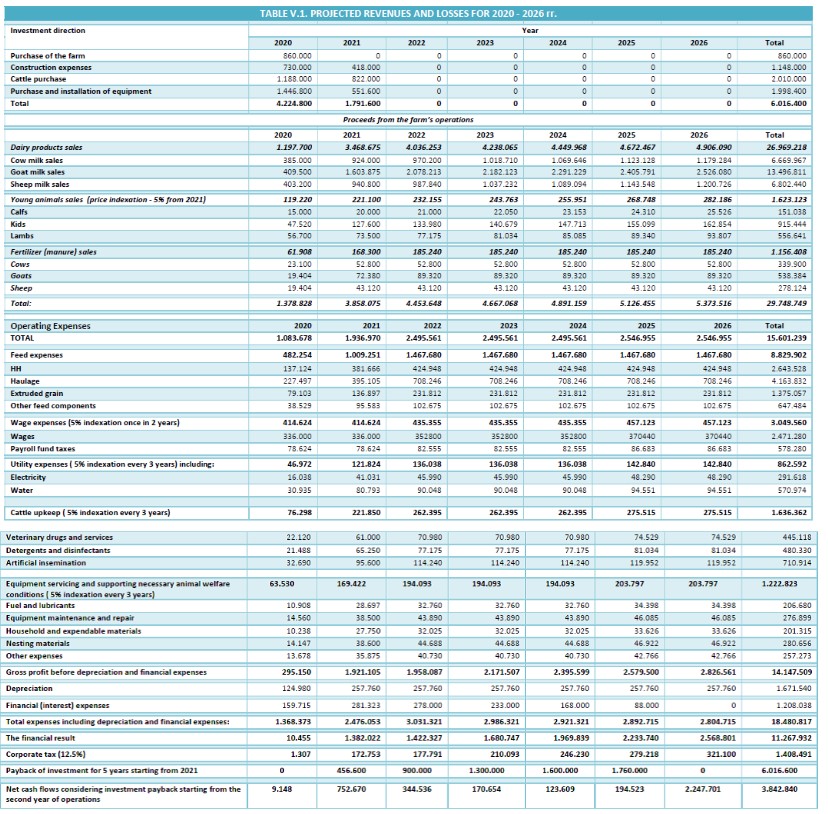

The table below summarizes the expected revenues, expenses, taxes and profits of the farm according to the main and more realistic scenario.

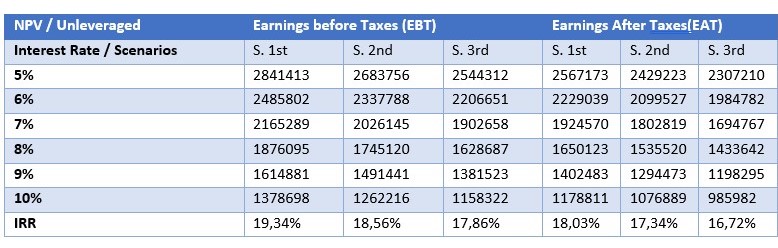

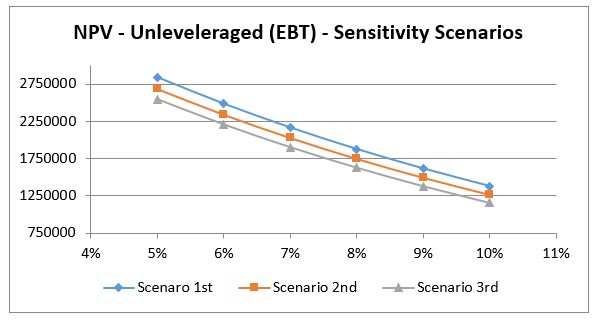

I.EARNINGS (EBT, EAT), NET PROFIT & IRR OF THE PROJECT (SCENARIOS)

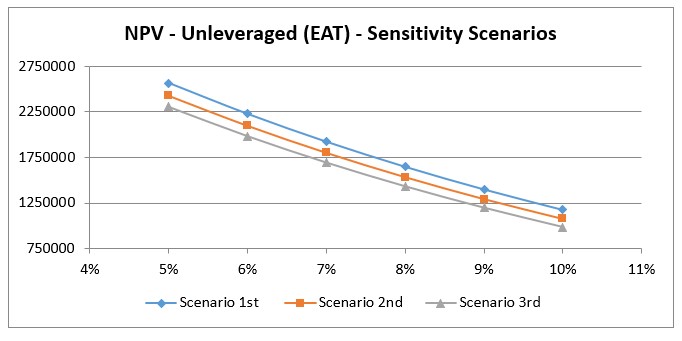

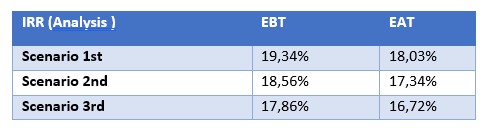

In our analysis, we considered two extreme scenarios in order to examine the sensitivity of the project in external crises related to the Cyprus economy, which will affect mainly the dairy production and sale business. We consider an absolute reduction in the incomes of 10% and 21% respectively.

Even in the worst scenario (revenue drop by 21%), the company would operate at a loss only in the first year of the project’s implementation. Certainly, such a decline in revenues would require a revision of the credit facility repayment plan and a prolongation of the credit agreement for 3 or 4 years.